March 21, 2012

By Thom Calandra @ Large www.babybulls.com

SAN FRANCISCO — A China-centric gold developer says China’s consumer price inflation is understated and real estate developers will melt down if the nation’s banks step away from largely vacant offices, subdivisions and warehouses.

The informed warning is good for gold and a wake-up call for soaring housing and commercial real estate prices in China.

Jim Moore of Inter-Citic Minerals (ICI in Canada and ICMTF in USA) gave his forecast before word of declining home prices in many China cities hit the business wire today.

Mr. Moore explained to a group of professional investors how rising gold demand, negative real interest rates and tens of billions of dollars of China cash seeking producers will boost mineral resource juniors that have suffered since the 2008 mortgage debt disaster.

Read More

Leave a Comment » |

Leave a Comment » |  China, dachang gold project, Gold, Inter-Citic Minerals, Market Commentary, thom @ Large, Thom Calandra, Torrey Hills Capital | Tagged: china, family, gold dachang, ho, ici, icmtf, inflation, jim moore, thom calandra, zijin |

China, dachang gold project, Gold, Inter-Citic Minerals, Market Commentary, thom @ Large, Thom Calandra, Torrey Hills Capital | Tagged: china, family, gold dachang, ho, ici, icmtf, inflation, jim moore, thom calandra, zijin |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

March 16, 2012

By Thom Calandra

OKALLA CAMP – Fresh core emerging in smooth cylinders and catalogued row by row at this Cambodia gold camp is pale rose.

Dr. Adrian Mann’s contract drillers just pulled this sample from the ground (Hole 29). The column of rock from perhaps 100 meters deep shows potassic alteration and what looks like secondary feldspar.

Minerals explorer Angkor Gold (ANK in Canada; ANKOF in USA) is little known to those who visit this bountiful country seeking Buddhist temples and irrawaddy fresh-water dolphins flipping in the Mekong River.

Read More

Leave a Comment » |

Leave a Comment » |  angkor gold, Gold Standard, Goldgroup, Mining, tanzania, Thom Calandra, Torrey Hills Capital | Tagged: angkor gold, ank, ankof, cambodia, community service, copper, copper fox, Gold, mekong, porphyry, thom calandra, vietnam |

angkor gold, Gold Standard, Goldgroup, Mining, tanzania, Thom Calandra, Torrey Hills Capital | Tagged: angkor gold, ank, ankof, cambodia, community service, copper, copper fox, Gold, mekong, porphyry, thom calandra, vietnam |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

February 4, 2012

INDIAN WELLS, California — I am paddle-boarding the video wave. Swift broadband speeds and neat video production values … well, moving pictures are making text reports look Neanderthal in comparison.

I don’t say that easily, as I am more a text-pert: newspapers, wire, Internet … than I am a broadcaster: CBS Radio, MarketWatch, national and local TV.

Here are a couple vids from the Cambridge House Metals Conference in Vancouver. On the actionable front, please note companies in the 3-minute splice that might have actionable events in coming days and weeks. In the RECAP video, for instance, you’ll see a few company posters and presenters at their exhibit hall booths. Jot down their names. I think one or two will see bust-out assays or sizeable additions to their compliant resources in short order. (More actionables in second half of this article.)

The Video: http://blog.cambridgehouse.com/2012/02/03/vancouver-resource-investment-conference-2012-recap/

Here is another

vid, this one me yakking with

Scott Gibson of Canada’s Kitco. (

See video.) I mention Dr. Copper and several companies that are developing what they believe are significant

gold-copper porphyrys. In Colombia and Nicaragua. Watch it.

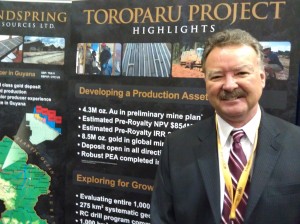

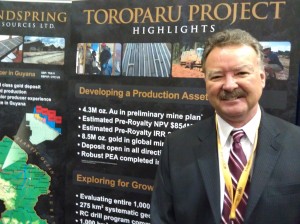

Sandspring's Richard Munson

On the Torrey Hills front: Scorpio Gold (SGN) shares are now above a buck. They’re a client of the firm, and I know CEO Peter Hawley and have seen the Nevada project. What else? Michael Nikiforuk from African Gold Group (AGG) is in Cape Town this week for the INDABA conference. So is CEO Paul Zyla from Xtra-Gold Resources (XTG). They are both clients, and I own shares of both and have seen their projects (Ghana, Mali) numerous times.

This is the first year in a while that I have not hopped a flight to Africa in February; it’s usually a good time to see properties because everyone is there for INDABA and one other show. I guess I have Cambodia (two paragraphs down for more) on the brain. I have a few folks scouting the Cape Town show for me and reporting back on the Africa companies I have surveyed over the years. These include Mike Jones and his Platinum Group Metals (PTM and PLG), which is a client of Torrey Hills and a South Africa mine developer, along with its neighbour, Robert Friedland’s Ivanhoe Nickel & Platinum. I have owned both shares, one private and one public, for many, many years.

My ownership list for the great continent of Africa includes PMI Gold (PMV), Stellar Diamonds (STEL in London), Tigray Resources (TIG), Canaco (CAN), Great Basin Gold (GBG), Platinum Group Metals (PLG), Ivanhoe Nickel & Platinum and West African Iron Ore (WAI). Oh, and one hapless and disorganized tantalum prospector in Mozambique that has melted down in value, and not UP: Noventa (NTA).

Next weekend, I’m speaking in the California desert.

Cambridge House California Feb. 11-12. That’s in Indian Wells, California, USA. If you have time, please come by and say hello. I have a few metals equities surprises that even the experts have not staked out. I speak on Sunday, Feb. 12. Lots of friends and colleagues will be there, including Cambridge House’s

Joe Martin, GATA’s

Bill Murphy, Chris Powell and, I am told, Murphy siblings; that’s plural siblings. The Queen of England is celebrating her 60th year of a monarchy; who knows

what in the name of gold or golf the Bill Murphy family is celebrating. I do know the non-profit educator

Gold Anti-Trust Action Comittee (GATA) is celebrating its 12th year of anarchy.

Also converging on this

Indian Wells hotel that I imagine will melt

up in the desert springs of gold, golf, and

GATA : our gang from Torrey Hills Capital, Texas asset manager Frank Holmes, diamond maven

Colin Ferguson and other

gold (

and golf) pros. I can’t wait. I went to graduate school in the Arizona desert and was lucky to snag a master’s degree or two amid the cacti and hallucinogens. For me, returning to the desert, ANY desert, is a melt-up, strip-down mineralized affair.

After the California desert, it’s off to Cambodia to see properties under development by Mike Weeks’ Angkor Gold (ANK). I own the shares, having broken a rule I set last year about NEVER purchasing anything before I see it with my own eyes. (The gold grades look giddy they’re so high. We’ll see.)

I also will be spending time with Mr. Weeks and his wife, Delayne Adams, as we deliver medical equipment from their stomping grounds in Alberta, Canada, and as we assist a Cambodia hospital. Mike and a group of his oil & gas friends have their own money in Angkor Gold; now isn’t that a crowd pleaser. Their community contributions in ravaged Cambodia qualify the two of them and their friends and company for nominations to the just-created (this moment) 2012 Siddhartha Award For Sacrifice & Grace. (Photo courtesy Angkor Gold)

Oh yes, before I forget, a friend at the health club in Strawberry this weekend dropped in to ask why Revett Minerals (RVM) is sitting back, share-price-wise, whilst lots of other silver companies have seen some heady share action these past two weeks. My answer on that is “Just Wait & See.” John Shanahan’s Revett is not just pure silver from the Troy Mine in Montana; it’s poly metallic. I think the shares this coming week will reach all-time highs as folks realize the potential of Revett’s Rock Creek project. I own the shares, and Revett is a Torrey Hills Capital client.

Revett, along with several other companies, including Manitoba’s Carlisle Gold (CGJ) and Ghana/Mali’s African Gold Group, are on my 2012 takeover roster. I own many shares of both, all purchased in the market; only AGG is a Torrey Hills client. Also on the cheap heap is Sandspring Resources (SSP), whose Guyana project I have seen a couple of times. It’s copper and gold. That’s CEO Rich Munson in the photo, above — at the Vancouver metals show. I own Sandspring shares, but they have been hammered — in fact, more than most any metals equity I follow.

On the SSP front, since I was a believer in the Guyana prospector as recently as five or six months ago, I have to say I am concerned to see Abraham Drost, who was president of Sandspring and is a Thunder Bay resident and geologist, leave Sandspring. I follow Tall Abraham as an indicator of hard work, clean living, smart corporate choices and safe driving (not always a given with brilliant geos). The good news is that Mr. Drost is now pitching in BIGTIME at Howard Katz’s Tamaka Gold, an Ontario project that I have seen and that is shaping up as the second coming of Osisko Meets Rainy Creek. Tamaka’s market debut, using the ticker TKT in Canada, is just around the corner. I think Tamaka might blow out the cobwebs that cloak Northeast Canada metals valuations. We’ll see.

Birthday wishes: To Hugh Clarke of Endeavour Silver (EXK and EDR); he turns a round-number this week; thank you, Hugh you, for contributing vastly to my monetary wealth here at home … and to my growing wealth of knowledge about silver, about Mexico and about coolness.

Read Thom’s Reports

THOM CALANDRA is a principal of Torrey Hills Capital and a lifelong journalist. He co-founded CBS MarketWatch and FT MarketWatch. (Also, co-founder of Stockhouse’s Ticker Trax) His reviews of natural resources companies are found on this Baby Bulls, at the Cambridge Cafe, on GATA.org and on Stockhouse. Also: The Gold Report, 321Gold.com and other publishers of metals material. Thom is an investor and a speaker for Cambridge House in Canada and the New Orleans Investment Conference. Thom also speaks in San Francisco, New York and in Europe. He lives with his family in California.

Leave a Comment » |

Leave a Comment » |  African Gold, cambridge house conferences, Copper, Gold, Thom Calandra, Torrey Hills Capital, Xtra-Gold | Tagged: angkor gold, cambodia, copper, Gold, indian wells, medical supplies, mike weeks, thom calandra, torrey hills |

African Gold, cambridge house conferences, Copper, Gold, Thom Calandra, Torrey Hills Capital, Xtra-Gold | Tagged: angkor gold, cambodia, copper, Gold, indian wells, medical supplies, mike weeks, thom calandra, torrey hills |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 27, 2012

By Thom Calandra

www.babybulls.com

VANCOUVER, Canada — Vancouver’s two January resources get-ups, Cambridge House for investors and B.C. Round Up for geos & technicians, gave us flogging five-day rains, one superb NHL hockey match … and plenty of hard-asset bravado:

- “I don’t own stocks any more; I own colored diamonds,” diamond seller Colin Ferguson told me at a private party I hosted with Cambridge House‘s Joe Martin. (I invite the guests and Joe entertains ’em.) Mr. Ferguson, a 51-year-old Vancouver Island resident, says we’ll see reports of diamond warehousing by aggressive hedge funds. Worldwide demand for diamonds is on track to exceed supply by 7 million carats. The “coloreds,” champagnes (cognac hues), pinks, blues and greens, are beginning to flash in fashion-minded markets. Colin will be at Mr. Martin’s Palm Springs investment conference at Indian Wells, California, in two weeks. I want to see more of these stones. (See: www. cambridgehouse.com)

Dr. Clarke At PMI Gold Booth

- “Poly-metallic mines and properties are always in demand,” Tom Macneill says. I came across Mr. Macneill, a lifelong Saskatchewan resident and longtime chief of 49 North Resources (FNR in Canada), across the street from Waterfront at lunchtime. Tom, sitting at a lunch counter, is sitting on his merchant bank’s 10-percent-plus ownership of surging DNI Metals (DNI). DNI is a northern Canada smorgasbord of elements in an expansive property portfolio. I am fortunate to own FNR and DNI after a fishing trip a couple years back with Tom, Bob Bishop, Doug Casey and others, way up there in Saskatchewan. (By the way, Mr. Macneill is hot on uranium prospectors right now — especially one big one whose first letter is C and its last O.)

- I tested my latest think on the exhibit floor at the Joe show; copper-gold porphyrys will outpace market gains of all metals equities in coming weeks. “When Dr. Copper is in the house, it’s a very, very, very good house,” says Don Mosher. Don represents Riverstone Resources (RVS), a Burkina Faso prospector whose shares look ready to bust out after a largely ignored resource report. A geologist I rely on for analysis, Dr. Peter Megaw of Minaurum (Gold (MGG), Candente Gold and others, told me, “Copper is a big-company business. A billion tonnes of half-percent copper with the gold credit blended in, that takes care of a lot of the risk of taking on a development.”

Read More

1 Comment |

1 Comment |  Avanti, Copper, EurOmax Resources, Gold, Gold Standard, Golden Valley Mines, Market Commentary, Mining, Molybdenum, Revett Minerals, Scorpio Gold, Thom Calandra, Torrey Hills Capital, Uranium | Tagged: cambridge house, canada, colombia, copper, ghana, Gold, mexico, nevada, tanzania, thom calandra |

Avanti, Copper, EurOmax Resources, Gold, Gold Standard, Golden Valley Mines, Market Commentary, Mining, Molybdenum, Revett Minerals, Scorpio Gold, Thom Calandra, Torrey Hills Capital, Uranium | Tagged: cambridge house, canada, colombia, copper, ghana, Gold, mexico, nevada, tanzania, thom calandra |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 23, 2012

Thom Calandra, successful resource investor, market commentator and Torrey Hills Capital Partner was interviewed this weekend by Bridget Anderson of Cambridge House International at the 2012 Vancouver Resource Investment Conference. During the just under 8 minute interview, Thom discusses some of the macro trends that are currently affecting today’s resource industry, as well as how he has used the tolerance of some geopolitical risk to improve his investment returns.

Click on the image below to go to the interview:

Leave a Comment » |

Leave a Comment » |  Market Commentary, Mining, Thom Calandra, Torrey Hills Capital |

Market Commentary, Mining, Thom Calandra, Torrey Hills Capital |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 18, 2012

SAN FRANCISCO – I got to see Aaron Keay of Revolution Resources as part of his swing through California.

Aaron, Rob McLeod, Pete Evans and Katie Lucas are developing the Carolinas’ “other” gold prospector in the Slate Belt. The dirt-cheap one.

I was there this past summer, getting acquainted with Revolution’s Champion Hills project thanks to senior geos Pete and Katie. (That is Katie holding some Champion core in the photo.)

Katie Lucas shows some core

Revolution Resources (OTCQX: RVRCF; TSX: RV) has two things going on right now. They are the Champion Hills district scale play in the slate belt of North Carolina (home to America’s original gold rush) and a recently optioned Universo project in Mexico, located next door to Goldcorp’s Camino Rojo property (4M oz gold and 68.3M oz silver) and on trend with Goldcorp’s mammoth Penasquito Mine (17.8M oz gold and 882M oz silver).

Revolution at the top end has CEO Aaron K., Chairman Mike Williams and VP Ex Rob M. the discovery team for Underworld Resources, which is now owned by Kinross.

Here is what got me when Aaron (in photo below) presented the RV vitals to a full room in San Francisco: 10,000 meters of Champion Hills drill holes coming in the next 30 days. I am such a hound for fresh assays and the potential for share gains.

Read More

Leave a Comment » |

Leave a Comment » |  cambridge house conferences, kinross, Revolution Resources, romarco, slate belt, Thom Calandra, Torrey Hills Capital | Tagged: aaron keay, cambridge house, Gold, north carolina, revolution resources, romarco minerals, slate belt, thom calandra |

cambridge house conferences, kinross, Revolution Resources, romarco, slate belt, Thom Calandra, Torrey Hills Capital | Tagged: aaron keay, cambridge house, Gold, north carolina, revolution resources, romarco minerals, slate belt, thom calandra |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 13, 2012

BabyBulls (ACCRA, Ghana) – Three companies, including our own African Gold Group (OTC Other: AGGFF; TSX-V: AGG), participated in a wheelchair donation program in West Africa this month. The wheelchairs go to needy residents of areas where metals prospectors and miners work. In this case, the good news came to 260 chairs in Mali and 260 in Ghana.

A longtime friend, Gordon Holmes of The Gold Report, spearheaded the wheelchair idea a few years ago via a winery he owns up the freeway from where I live in northern California.

A longtime friend, Gordon Holmes of The Gold Report, spearheaded the wheelchair idea a few years ago via a winery he owns up the freeway from where I live in northern California.

“Each shipping container holds 260 chairs,” Gordon told me today (Thursday).

I got to experience the wheelchair spirit in November, when Great Panther Silver, another of our Torrey Hills clients, and Endeavour Silver chipped in to donate a bunch of them near Guanajuato in Mexico. The emotion was intense.

Read More

Leave a Comment » |

Leave a Comment » |  African Gold, cambridge house conferences, Gold, Great Panther, Silver, Thom Calandra, Torrey Hills Capital |

African Gold, cambridge house conferences, Gold, Great Panther, Silver, Thom Calandra, Torrey Hills Capital |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 9, 2012

By Thom Calandra

babybulls.com

Energy investing ideas are occasionally my cup of coffee. Years ago, five or so years of my almost 30-year newspaper career was covering Chevron Corp., which was based in San Francisco. On the wire front, those who followed me at my MarketWatch.com got my takes on alternative energy, on Oklahoma natural gas and on other LNG (liquid natural gas) investments.

I know some of the new energy crowd, among them Ross Beaty of hydrothermal Alterra Energy, Robert Friedland of Ivanhoe Energy … a few uranium prospectors from Saskatchewan and Australia … and a collection of rock geologists who started their careers in petroleum. At Bloomberg in London, I was right around the corner from Royal Shell central. North Sea oil traders and shippers are thick as the trees in Sherwood Forest in the city of London.

The other day, looking at our roster of Torrey Hills Capital clients, I came across Lynden Energy (TSX-V: LVL; OTC: LVLEF). I did a double-take; about two years ago, I asked geologist Raul Madrid and a partner of his, Richard Andrews, over to breakfast to hear about their Texas lone star Lynden. (See Thom’s original article.)

Read More

Leave a Comment » |

Leave a Comment » |  cambridge house conferences, Energy, Lynden Energy, oil, Texas, Thom Calandra, Victoria Gold | Tagged: babybulls, bloomberg, chk, crownrock, fields, lvl, lynden energy, mineral, nevada, oil, raul madrid, shell, thom calandra, torrey hills |

cambridge house conferences, Energy, Lynden Energy, oil, Texas, Thom Calandra, Victoria Gold | Tagged: babybulls, bloomberg, chk, crownrock, fields, lvl, lynden energy, mineral, nevada, oil, raul madrid, shell, thom calandra, torrey hills |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

January 6, 2012

Cranes Keep Bringing Nevada Gold To Scorpio's Treasury

By Thom Calandra

BabyBulls.com

MINERAL RIDGE, NEVADA — Peter Hawley’s current gold producer, Scorpio Gold Corp. (TSX-V: SGN and OTC: SRCRF), hits the ground running.

Scorpio, a client of our Torrey Hills Capital, is starting off the new year with pit results from its Mineral Ridge project in western Nevada. The Mary Pit shows 10.67 meters of 3.65 g/t gold and 4.57 meters of 13.06 g/t silver.

Our takeaway: an overburden removal at the Mary Pit began in late autumn 2011 and it appears to be working. Scorpio CEO Peter Hawley says the pit looks on track to nail a general target for 2012 production rate of 60,000 to 80,000 ounces of gold equivalent.

We’ll see a revised mineral estimate at Mineral Ridge sometime soon.

Our team at Torrey Hills and I have been to Mineral Ridge several times. Investors seeking a solid gold producer eventually will see Scorpio account for far more gold ounces produced (and sold) in its quarterly reports than is the case now. And in a producer category.

Currently, Scorpio Gold is not classified as a “producer” so it accounts for sales of metal on the balance sheet as mining assets.” The trigger for this change is four consecutive months of 4,500 ounces or better per month. Thus, sales become net income.

Based on what we see happening at Mineral Ridge in terms of tonnes moved to the processing plant and average grades, we believe that Scorpio should cross that line well within the first half of 2012.

At a cost of $600 per ounce (this estimate from a recent Jennings Research Report), a target of 60,000 ounces creates a quarterly top-line earnings number in the neighborhood of around $15 million. Current market cap of Scorpio is $100 million. I am an owner of the shares.

Recent Travel Digest from Mineral Ridge here: http://www.babybulls.com/PDF/Scorpio_Gold-Mineral_Ridge_Travel_Dispatch_Oct_2011_FINAL.pdf

Recent Q & A with Peter Hawley, CEO of Scorpio Gold here: http://youtu.be/uMCtQKPqNl4

VANCOUVER: I’ll be speaking at Cambridge House’s January gathering of 500 hard asset companies in two weeks. See: www.cambridgehouse.com.

— Thom Calandra is a lifelong author whose work has appeared in dozens of newspapers, newsletters, magazines and across the Web. He is a founder of CBS MarketWatch, now Dow Jones MarketWatch. He is a member of Torrey Hills Capital. Scorpio Gold is a client and provides stock options to Torrey Hills in return for investor outreach services. Your comments are welcome, but please, no foul language. (Photos — Thom Calandra)

Leave a Comment » |

Leave a Comment » |  Gold, Gold Bulliion, Mining, Scorpio Gold, Thom Calandra, Torrey Hills Capital | Tagged: babybulls, bullion, cambridge house, crane, Gold, grams, hawley, mineral, net income, nevada, ounces, producer, ridge, scorpio, stock, winner |

Gold, Gold Bulliion, Mining, Scorpio Gold, Thom Calandra, Torrey Hills Capital | Tagged: babybulls, bullion, cambridge house, crane, Gold, grams, hawley, mineral, net income, nevada, ounces, producer, ridge, scorpio, stock, winner |  Permalink

Permalink

Posted by babybulltwits

Posted by babybulltwits

Posted by babybulltwits

Posted by babybulltwits

Inter-Citic CEO On Gold, China and Stocks: Thom @ Large

March 21, 2012By Thom Calandra @ Large www.babybulls.com

SAN FRANCISCO — A China-centric gold developer says China’s consumer price inflation is understated and real estate developers will melt down if the nation’s banks step away from largely vacant offices, subdivisions and warehouses.

The informed warning is good for gold and a wake-up call for soaring housing and commercial real estate prices in China.

Jim Moore of Inter-Citic Minerals (ICI in Canada and ICMTF in USA) gave his forecast before word of declining home prices in many China cities hit the business wire today.

Mr. Moore explained to a group of professional investors how rising gold demand, negative real interest rates and tens of billions of dollars of China cash seeking producers will boost mineral resource juniors that have suffered since the 2008 mortgage debt disaster.

Read More